When I first heard about insurance companies using internet-of-things (IoT) devices to monitor driving habits, I remember cynically thinking, “They just want to find a reason to justify raising my premiums.”

I have seen too many product companies that didn’t stop to ask the question, “Should we?” and instead only asked, “Can we?” This led to a host of IoT products that nobody wants (think internet-connected toasters and refrigerators).

It wasn’t until I began learning more about how the insurance industry works that I came to appreciate these IoT products. In fact, when I considered the win-wins these products bring, I even considered using one myself.

In this post, I’ll highlight three innovative InsurTech companies that are using IoT devices to help their customers.

Pay-per-mile Policies

By Miles is a UK-based InsurTech startup that was founded in 2016. The company’s mission is to make auto insurance fairly priced for all drivers by offering a pay-per-mile cost structure.

It’s well known that accident risk is higher for drivers who are on the road more. Customers who drive infrequently pose less of a risk and thus should need to pay a less hefty a premium. By Miles recognized this and built their business model around it.

It’s well known that accident risk is higher for drivers who are on the road more. Customers who drive infrequently pose less of a risk and thus should need to pay a less hefty a premium. By Miles recognized this and built their business model around it.

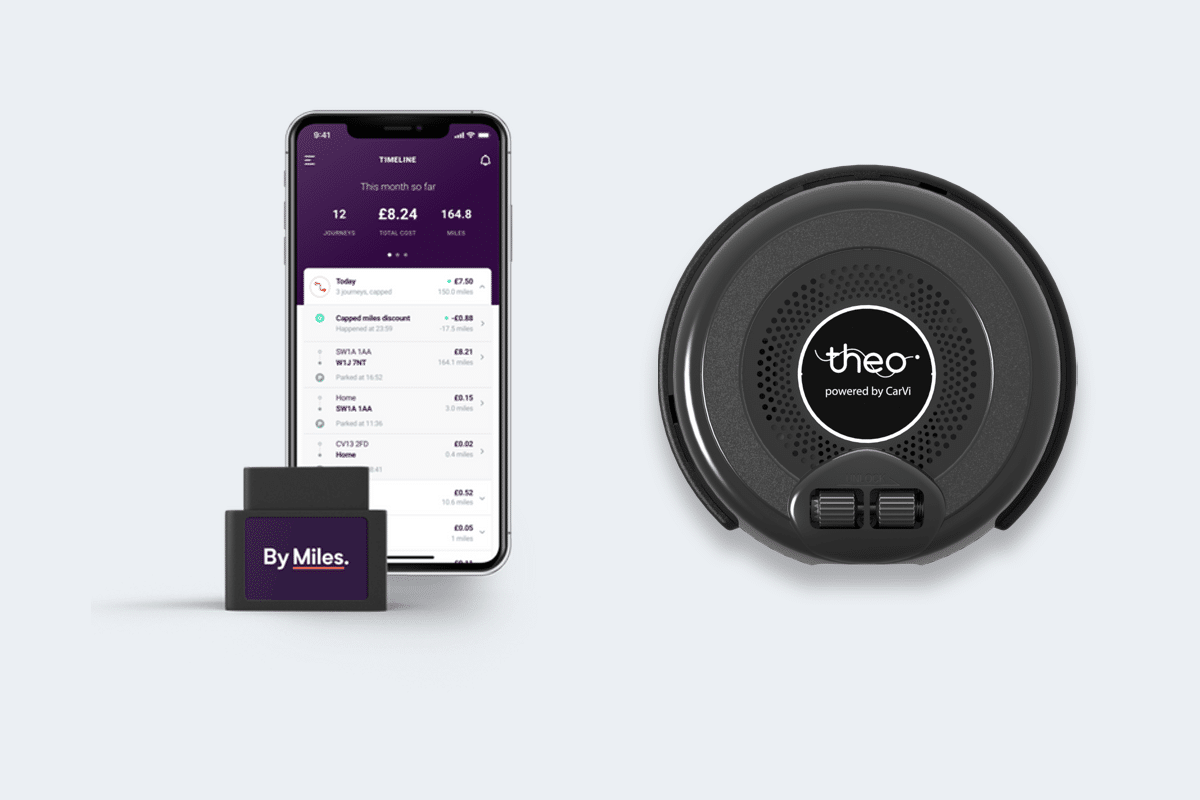

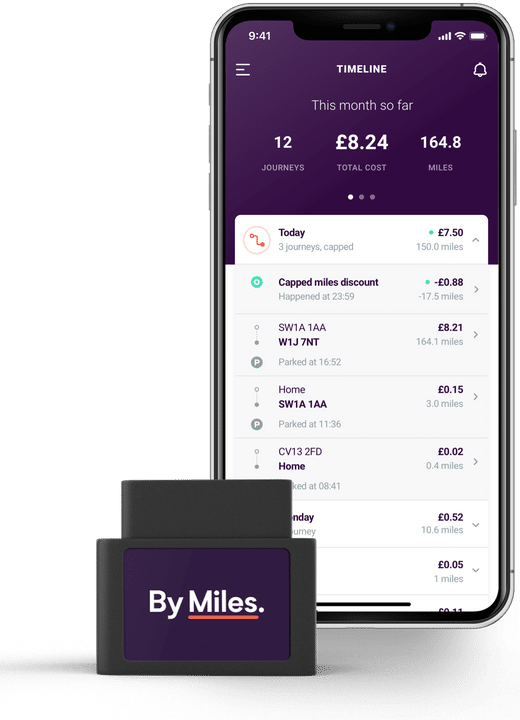

Customers of By Miles pay a fixed annual cost that covers their car while it’s parked, plus a per-mile fee to cover their vehicle for its time on the road. A mobile application provides customers with a convenient dashboard that shows their current bill for the month.

By Miles accomplishes this through a small IoT device, approximately the size of a matchbox, which connects to the vehicle under the dashboard. By monitoring messages produced by the vehicle, the device is able to determine the number of miles driven. It periodically sends that information to the company’s servers via cellular data connection (like sending a text message).

Bonus Feature: Being a bit of a car nerd, one feature that appeals to me is the fact that the By Miles device also serves as a vehicle diagnostic tool! Because the device connects to the vehicle’s diagnostic port, it’s able to read fault codes that occur while you’re driving. Using the companion mobile app, you can view these faults and stay informed about potential issues that your vehicle may have.

This feature is a great example of a clever tactic that creates an incentive for people to install By Miles’ mobile app and thus creates an opportunity to increase customer engagement with other features/services. A thoughtful technology partner can help you identify these opportunities that may be low-hanging fruit.

Voice-enabled, In-car Assistance

ThingCo is also trying to shake up the auto insurance world by incorporating a smart device onboard the vehicle. With their AI-enabled telematics device, ThingCo seeks to not only reward drivers for safe and eco-friendly driving but also help them out in times of need.

The ThingCo devices, the Theo and the Little Theo, are enabled with Amazon’s Lex technology (Alexa), which allows conversational interaction through voice commands. Founder and CEO Mike Brockman believes that this voice-enabled functionality is a key differentiator for their business. He had this to say in a recent interview with FinTech Global:

The ThingCo devices, the Theo and the Little Theo, are enabled with Amazon’s Lex technology (Alexa), which allows conversational interaction through voice commands. Founder and CEO Mike Brockman believes that this voice-enabled functionality is a key differentiator for their business. He had this to say in a recent interview with FinTech Global:

I’m a big fan about voice technology, because if you combine voice with these other technologies, you can turn these devices into a true connected car device, rather than a sort of black box. Voice changes the whole game.

While it may sound like a gimmick, the voice-enabled functionality unlocks a very valuable feature: the ability to alert the driver without causing them to look away from the road. For example, if you’ve been driving for too many hours without a break, Theo will remind you and even suggest a convenient place for you to pull off.

An onboard HD camera further enables the Theo device to function as a full-fledged active driver assistance system (ADAS). This means it can detect the distance between it and the vehicle ahead and thus warn the driver of a potential collision.

Finally, an accelerometer is used to monitor the car’s movement and detect crash incidents. If it detects a crash, the device can ask the driver if they’re okay and alert emergency services.

Building a voice-enabled product is not as difficult as you might think. Services provided by companies like Amazon Web Services and Microsoft provide the necessary building blocks from a technical standpoint. The greatest challenge is creating an engaging experience for the customer.

Water-damage Prevention

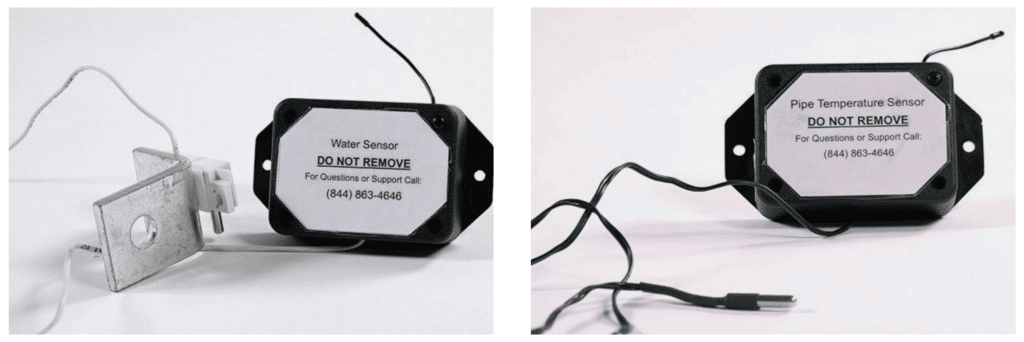

HSB Canada is using IoT devices in homes and businesses to help customers prevent expensive damages. Billions of dollars in claims are paid out each year; water damage is the second highest cause of loss, with wind and hail coming in first.

Sensor Systems by HSBincludes a variety of different sensor types that can detect water leakage, frozen pipes, or critical indoor temperatures. This early warning system can alert property owners to a dangerous situation before damage occurs, potentially saving them thousands of dollars.

InsurTech Innovation

The insurance industry may seem archaic to some, but in the year 2021, the industry is bustling with innovation. IoT is just one area where innovators are making a difference, but there are many more areas being explored.

The exciting thing is, premiums are directly related to the costs associated with claims paid out. If insurance companies can find creative ways of preventing accidents and property damage, we can all benefit.

In 2021, internet-connected products have become so commonplace that the technologies needed to create them (both hardware and software) have become commoditized and structured into off-the-shelf tools. These tools handle all of the boiler-plate functionality (device provisioning, device management, data collection, etc.) leaving only minimal configuration and development effort needed to launch a product.

Learn more about Atomic Object’s custom insurance software development services and expertise.